|

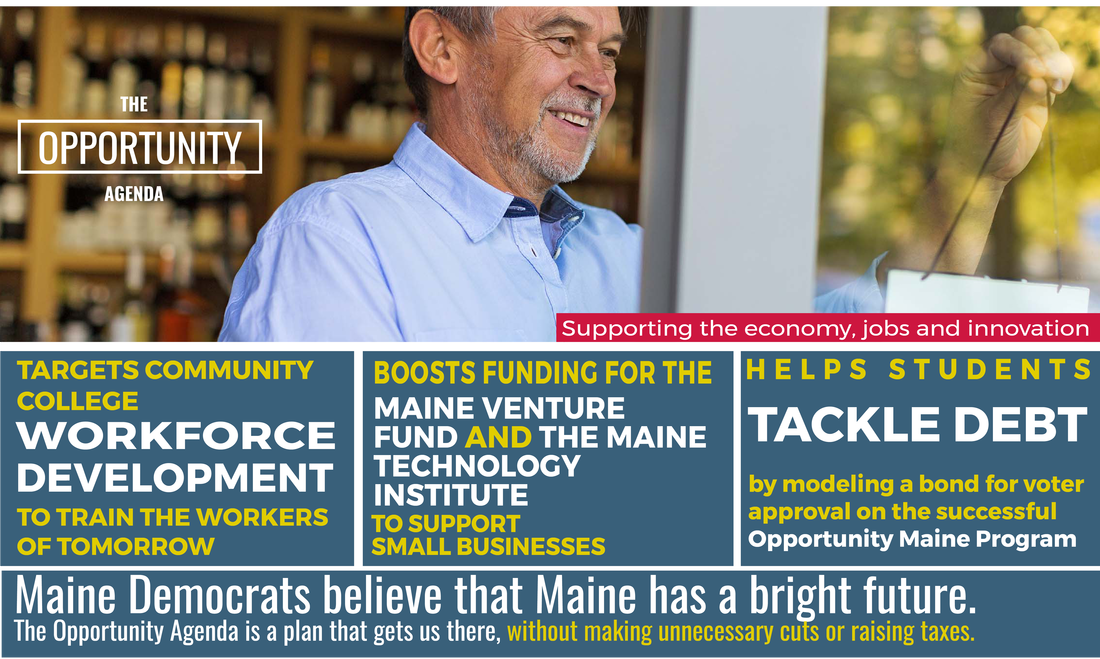

This week, I was proud to stand with my Democratic colleagues in the State House to introduce the Opportunity Agenda - our budget proposal. Now, I'm pleased to share our plan with you. Today, we have the opportunity to pass the largest property tax cut in our state’s history — $150 million in direct property tax relief so that more Mainers can be secure in their homes. We have the opportunity to fully fund our public schools, just like voters demanded, so that every Maine student can get a good education regardless of their ZIP code. We have the opportunity to provide meaningful student debt relief for Mainers held back by the crushing weight of college loans. And we have the opportunity to support new jobs with smart, targeted investments in our infrastructure, our community colleges and the innovators and entrepreneurs who are ready to build a stronger economy. The Opportunity Agenda achieves all this and more. The best part is we can do all of it without raising a single cent in new taxes. Projected economic growth and new revenues already established in Maine law more than cover the cost of these critical investments in our future. Our budget provides a stark contrast to the proposal introduced by Gov. Paul LePage in January. I’ve looked over the governor’s budget and found a plan that puts too many Mainers further behind. His proposal cuts funding for our schools. It needlessly takes health insurance away from thousands of vulnerable families. It pushes property taxes higher and higher, at a time when skyrocketing mil rates are pushing seniors and families closer to the edge.

All of these painful cuts are used to fund a tax cut that primarily benefits the very wealthiest Mainers. In fact, the governor’s plan would actually raise taxes for the bottom 80 percent of earners in Maine. The governor's budget is a great deal for the lucky few. The Opportunity Agenda is a budget for the rest of us.

3 Comments

Sue Burnell

4/7/2017 07:14:39 pm

The highlights sound great for hard working Mainers and our senior population. I look forward to hearing the details at a town meeting. Thanks for all your hard work!

Reply

Mark Sladen

4/8/2017 05:34:09 am

This sounds very good. I hope we can get it through. Thank you for your continued hard work.

Reply

Barry Noble

4/8/2017 09:16:35 am

Thanks for the hard work and opportunity to comment. I suspect Maine needs a statewide “Property Tax Framework for the Information Age”. The property Tax Framework itself needs to be sensitive to seasonal, coastal, rental, owner age, use, etc. The mill rate for the various categories should be set locally, but the real property, category framework should be statewide. Consistent real property data will allow use of the data for economic development, infrastructure investment, and social fairness, while avoiding complicated mixed basis systems which will, in and of themselves increase administrative costs. The key to developing a statewide property tax framework is thoughtful construction of the property categories. For example, single family, seasonal, rental might be a different category from single family, seasonal, owner occupied. And no, I’m not after the “out-a-state-rs” The rate per category would be locally determined. There are international and state category examples that can be found on the internet. Simply put direct, local manipulation of the mill rate per property category is less expensive and much more sensitive to local circumstances than trying to administer the coordination of multiple systems at the state or even federal levels e.g. property, income, means, etc. In fact, enforcement of say, a ‘sales’ tax on internet “Airbnb” rentals would require that the property be properly classified in the first place, would it not? Think simplification rather than complicated system coordination. Have a great day and keep up the good work! ~B

Reply

Leave a Reply. |

State Budget Blog

Latest information regarding the state budget details. Raw information so that you can make up your own mind. Archives

April 2017

Categories |

RSS Feed

RSS Feed