|

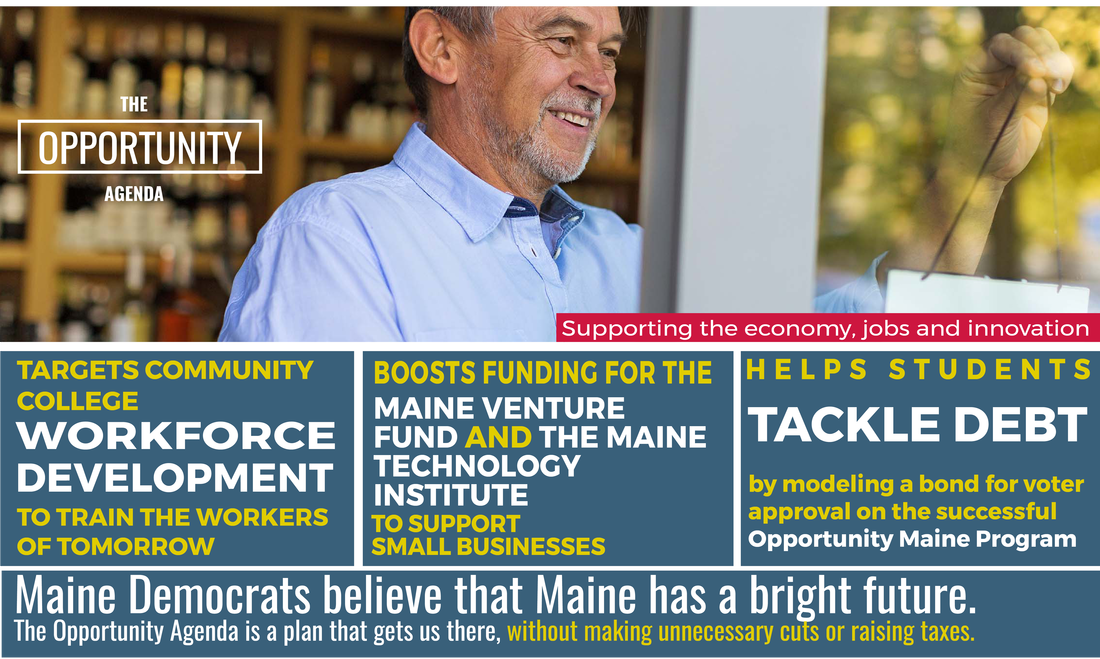

This week, I was proud to stand with my Democratic colleagues in the State House to introduce the Opportunity Agenda - our budget proposal. Now, I'm pleased to share our plan with you. Today, we have the opportunity to pass the largest property tax cut in our state’s history — $150 million in direct property tax relief so that more Mainers can be secure in their homes. We have the opportunity to fully fund our public schools, just like voters demanded, so that every Maine student can get a good education regardless of their ZIP code. We have the opportunity to provide meaningful student debt relief for Mainers held back by the crushing weight of college loans. And we have the opportunity to support new jobs with smart, targeted investments in our infrastructure, our community colleges and the innovators and entrepreneurs who are ready to build a stronger economy. The Opportunity Agenda achieves all this and more. The best part is we can do all of it without raising a single cent in new taxes. Projected economic growth and new revenues already established in Maine law more than cover the cost of these critical investments in our future. Our budget provides a stark contrast to the proposal introduced by Gov. Paul LePage in January. I’ve looked over the governor’s budget and found a plan that puts too many Mainers further behind. His proposal cuts funding for our schools. It needlessly takes health insurance away from thousands of vulnerable families. It pushes property taxes higher and higher, at a time when skyrocketing mil rates are pushing seniors and families closer to the edge.

All of these painful cuts are used to fund a tax cut that primarily benefits the very wealthiest Mainers. In fact, the governor’s plan would actually raise taxes for the bottom 80 percent of earners in Maine. The governor's budget is a great deal for the lucky few. The Opportunity Agenda is a budget for the rest of us.

3 Comments

Below is the information regarding the Governor's recent release of his 2018-2019 state budget costing over $6.8 billion. The documents below are from the Maine Bureau of the Budget and does not include my own analysis or targeted summaries for each section. I feel it's important for you to get the documents I receive for your own review. Contact me if you have any concerns, suggestions, or opinions on the state budget proposed below.

Details of the final compromise between Senate Democrats, House Democrats, Senate Republicans, and House Republicans on the $6.7 billion state budget this session. In the House, the original budget out of the Appropriations Committee, LD 1019, passed 101 to 47. The final budget compromise that made changes to that report and finalized by leadership on both sides and in both chambers, passed unanimously during it's first vote avoiding a state government shutdown if the votes hold upon almost certain veto from the Governor. Below are some of the key elements to the plan: UPDATE: The House has voted to override the Governor's veto of the 2-year budget 114 to 34. Below is the first two weeks of public hearings in Appropriations regarding the Governor's proposed 2 year budget.

Below is a breakdown of the Governor's proposed 2-year budget as prepared by the Office of Fiscal and Program Review. Due to the $100 million DHHS shortfall and $35 million in revenue reprojection and additional funding requests, a supplemental budget is needed. A supplemental budget is a bill that is intended to bring the state budget into balance within a biennium. With that being said the following are a few key points you need to know that Appropriations weighed in on for the final draft of the supplemental budget.

|

State Budget Blog

Latest information regarding the state budget details. Raw information so that you can make up your own mind. Archives

April 2017

Categories |

RSS Feed

RSS Feed